Markets go into tailspin after RBI’s rate hike surprise; Sensex, Nifty slump over two per cent

MUMBAI, May 4: Equity markets fell sharply in late afternoon trade on Wednesday, with the Sensex and Nifty diving over 2 per cent each after the RBI in a surprise move hiked the benchmark lending rate to 4.40 per cent to contain inflation.

The 30-share BSE benchmark tumbled 1,306.96 points or 2.29 per cent to settle at 55,669.03.

During the day, it plummeted 1,474.39 points or 2.58 per cent to 55,501.60.

The NSE Nifty tanked 391.50 points or 2.29 per cent to finish at 16,677.60.

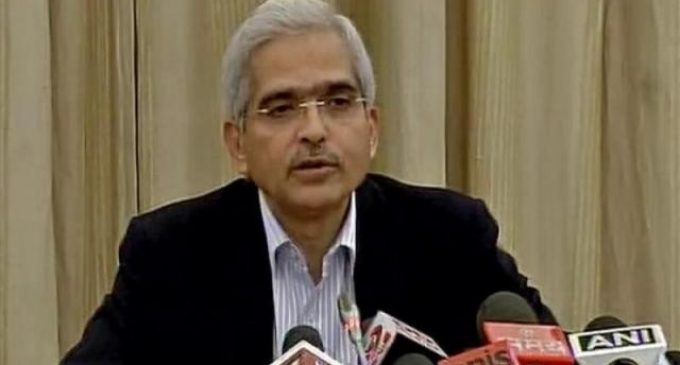

The Reserve Bank of India (RBI) increased the benchmark lending rate by 40 basis points to 4.40 per cent in a bid to contain inflation, which has remained stubbornly above the target zone of 6 per cent for the last three months.

The decision follows an unscheduled meeting of the Monetary Policy Committee (MPC), with all six members unanimously voting for a rate hike while maintaining the accommodative stance.

“The MPC’s decision, in an unscheduled meeting, to raise the repo rate by 40 bps and CRR by 50 bps is a surprise since it came on the LIC IPO opening date.

MPC’s proactive move is justified from the perspective of inflation management, but the timing leaves a lot to be desired.

“The above 1,000 point crash in Sensex has soured the sentiments on the opening day of India’s largest IPO,” said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

From the Sensex pack, Titan, Bajaj Finserv, Bajaj Finance, IndusInd Bank, HDFC Bank, RIL, Asian Paints, Maruti and Dr Reddy’s were the prominent losers.

In contrast, PowerGrid, NTPC and Kotak Mahindra Bank closed in the green.

Markets in Seoul and Hong Kong settled in the red.

Bourses in Europe were also trading lower in the afternoon session.

Stock exchanges in the US surged in trade on Tuesday.

Meanwhile, international oil benchmark Brent crude jumped 3.12 per cent to USD 108.3 per barrel.

Foreign institutional investors offloaded shares worth Rs 1,853.46 crore on Monday, according to stock exchange data.

-The India Today