RBI hikes repo rate by 50 bps to 5.4% to tame inflation

NEW DELHI, AUG 8: The Reserve Bank of India (RBI) on Friday hiked the repo rate by 50 basis points (bsp) to 5.4 per cent with immediate effect, crossing the pre-pandemic level of 5.15 per cent.

RBI’s rate-setting panel — the Monetary Policy Committee (MPC) — met for three days from August 3 to deliberate on the prevailing economic situation.

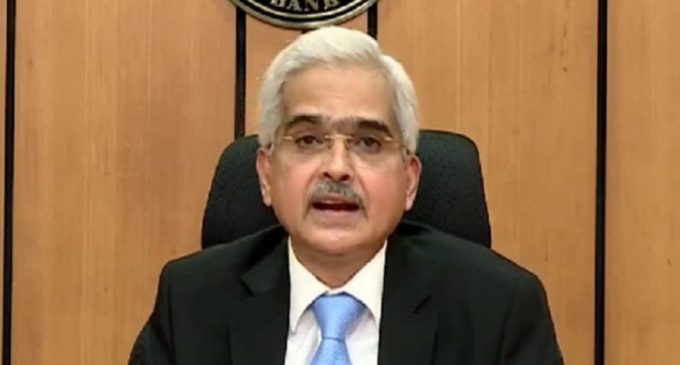

“MPC decided to focus on withdrawal of accommodation to keep inflation within target while supporting growth,” RBI Governor Shaktikanta Das said.

The MPC decided that the Standing Deposit Facility (SDF) rate stands adjusted to 5.15 per cent and the Marginal Standing Facility (MSF) rate and bank rate at 5.65 per cent.

The real GDP growth projection for 2022-23 is retained at 7.2 per cent with Q1 – 16.2 per cent, Q2 – 6.2 per cent, Q3 – 4.1 per cent and Q4 – 4 per cent with risks broadly balanced.

Furthermore, the real GDP growth for Q1 2023-24 is projected at 6.7 per cent, Shaktikanta Das stated.

This is RBI’s third rate hike in the current financial year. In its off-cycle monetary policy review in May, the RBI hiked the policy repo rate by 40 basis points or 0.40 per cent to 4.40 per cent.

Then in June, the RBI further raised the rate to 4.90 per cent, a 50 basis points increase.

Both the central bank and the government have been taking steps to contain inflation which is ruling above the RBI’s comfort level of 6 per cent since January this year.

Finance Minister Nirmala Sitharaman in Rajya Sabha on Tuesday said, “We have made sure that the Reserve Bank of India and the government, put together, are taking enough steps to make sure that it (inflation) is kept in the band of 7 or ideally below 6.”

-The India Today