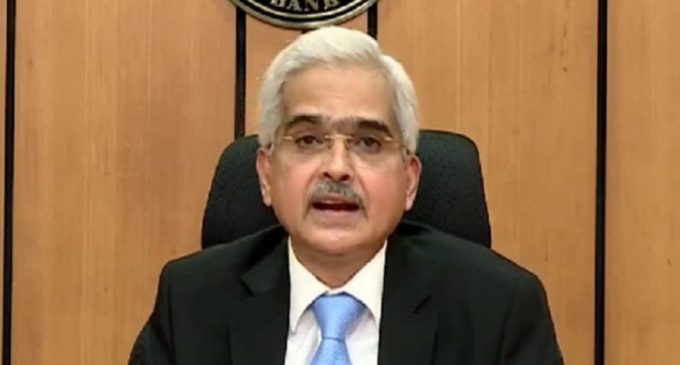

RBI keeps interest rate unchanged at 6.5%, lowers GDP projection to 6.6%, cuts CRR to 4%

MUMBAI, DEC 6 : The Reserve Bank of India (RBI) on Friday kept the benchmark interest rate unchanged at 6.5%, marking the 11th consecutive time the lending rate has remained steady.

The RBI’s Monetary Policy Committee (MPC) opted against any knee-jerk reaction to the growth slowdown in the second quarter with a repo rate cut, emphasising the need to be prudent and measured in its response to macroeconomic data.

However, it offered cheaper funds to the economy by reducing the cash reserve ratio by half a percentage point (50 bps) to 4%. This reduction will release as much as Rs 1.16 trillion of lendable money to the banks.

Announcing the status quo policy, with the key repo rate maintained at 6.5%, Governor Shaktikanta Das justified the decision, which was supported by a 4-2 vote by the panel.

He explained that all high-frequency macro data since October indicated that the economy has bottomed out and remains resilient, which does not warrant any knee-jerk policy measures.

However, given that the first-half numbers have come out much lower than projected, Das—whose six-year term ends next week and is likely to be extended for a third term—said the panel revised the full-year growth forecast down to a low 6.6% from the earlier 7.2%.

Similarly, the panel marginally revised the inflation forecast for the full year upwards to 4.8%, due to the significant spike in the past two months.

Regarding the cash reserve ratio cut (CRR), the governor explained that the move aims to maintain adequate systemic liquidity, considering the upcoming advance tax outflows and rising credit demand. He also noted that the rate has been reduced to the historical level of 4%, a level last seen in April 2023, when the rate was increased to 4.5%.

The CRR is the percentage of a bank’s total deposits that it is required to maintain in liquid cash with the RBI. The CRR percentage is determined by the RBI from time to time.

Key announcements by RBI Governor:

RBI to continue with ‘neutral’ monetary policy stance

Iterest rate unchanged at 6.5% for the 11th time in a row

GDP growth for July-September at 5.4%, lower than expectations

Retail inflation forecast raised to 4.8% for FY25, up from earlier forecast of 4.5%

GDP growth projection for current financial year revised to 6.6%, down from 7.2%

Cash Reserve Ratio reduced to 4% from 4.5%, making Rs 1.16 lakh crore liquidity available for banks

Last mile of inflation is proving to be prolonged and arduous

Lingering food price pressures are likely to keep inflation elevated in Q3, though Rabi production is expected to bring relief

Near-term inflation growth outlook has somewhat turned adverse since last monetary policy in October

Indian rupee remains less volatile compared to its peers in emerging market economies

Indicators suggesting economic slowdown in Q2 bottomed out

Financial parameters of banks and NBFCs continue to be strong; health of the financial sector is at its best

Growth outlook is resilient but requires close monitoring

Gains in broad direction of disinflation, despite a recent uptick, need to be preserved

Durable price stability is necessary to secure strong foundation for growth

Interest rate ceiling on NRI deposits raised with aim to strengthen rupee

Current account deficit will remain at sustainable level in FY25,

-PTI