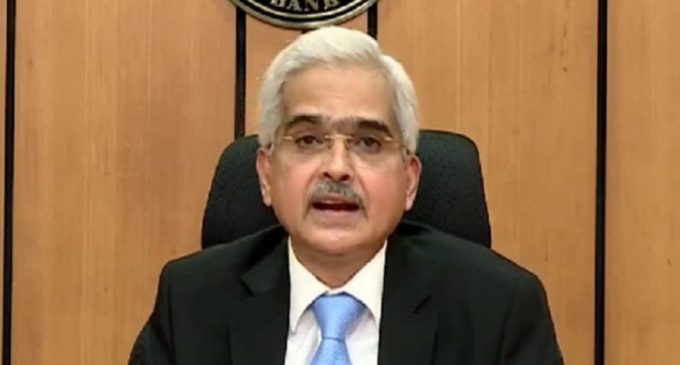

RBI repo rate: Interest rate increased to 4.90%, EMIs likely to go up

New Delhi, June 8 :The Reserve Bank of India on Wednesday announced a hike in the repo rate by 50 basis points to 4.90 per cent.

While the inflation rate has been projected at 6.7 per cent for the financial year 2022-23, the RBI remains hopeful that the economy will grow at 7.2 per cent in the current fiscal.

The decisions were announced by RBI Governor Shaktikanta Das after three-day deliberations of the Monetary Policy Committee (MPC).

Last month, the MPC raised the key policy rate (repo) by 40 basis points to 4.4 per cent to tame the rising inflation.

It was the first rate hike since August 2018.

Repo rate or repurchasing option’ rate is the rate at which the RBI lends money to commercial banks. The repo rate is considered as an important tool to control inflation.

The MPC voted unanimously to increase the policy repo rate by 50 bps to 4.90 per cent, said RBI Governor Shaktikanta Das.

When the RBI increases the repo rate, banks generally follow it by hiking interest rates against home loans, car loans and others. If banks increase interest rates, then equated monthly installments (EMIs) also go up, impacting borrowers.

According to the provisional estimates released by the National Statistical Office (NSO) on May 31, India’s gross domestic product (GDP) growth in the financial year 2021-22 was estimated at 8.7 per cent. This level of real GDP in 2021-22 has exceeded the pre-pandemic, i.e., 2019-20 level, said the RBI Governor.

The RBI has kept the real GDP growth forecast for FY 2022-23 at 7.2 per cent.

India is likely to grow at 16.2 per cent in quarter 1 of FY 2022-23 (April-June), 6.2 per cent in quarter 2 (July-September), 4.1 per cent in quarter 3 (October-December) and 4 per cent in quarter 4 (January-March).

With the assumption of a normal monsoon in 2022 and average crude oil price in the Indian basket of $105 per barrel, inflation is now projected at 6.7 per cent in the financial year 2022-23, said RBI Governor Shaktikanta Das.

Consequently, the standing deposit facility SDF rate stood adjusted to 4.65 per cent and the marginal standing facility, MSF rate and bank rate, to 5.15 per cent, the RBI Governor said.

The hike in interest rate comes as consumer price index (CPI) based retail inflation, which the Reserve Bank of India factors in while arriving at its monetary policy, galloped for a seventh straight month to touch an 8-year high of 7.79 per cent in April.

Inflation is rising mainly on account of surging commodity prices, including fuel. The ongoing Russia-Ukraine war has further pushed up commodity prices across the globe.

The wholesale price-based inflation has remained in double digits for 13 months and touched a record high of 15.08 per cent in April.

The government has tasked the Reserve Bank to ensure consumer price index-based inflation remains at 4 per cent with a margin of two per cent on either side.

Prior to Wednesday’s announcement, the RBI Governor indicated that there may another hike in the repo rate, though he refrained from quantifyi.

-PTI