RBI raises rates and growth outlook; inflation seems set to fall

HYDERABAD,FEB 8: As widely expected, the RBI raised the key benchmark policy rate by 25 bps in a 4-2 split vote on Wednesday. The overnight repo rate now stands at a nice round number of 6.5%.

After a 10-month miserable period, headline inflation seems ready to bend, so the central bank lowered both its Q4, FY23 projection and the full fiscal FY23 estimate at 5.6% and 6.5% respectively. Last December, it pegged them at 5.9% and 6.7%, respectively.

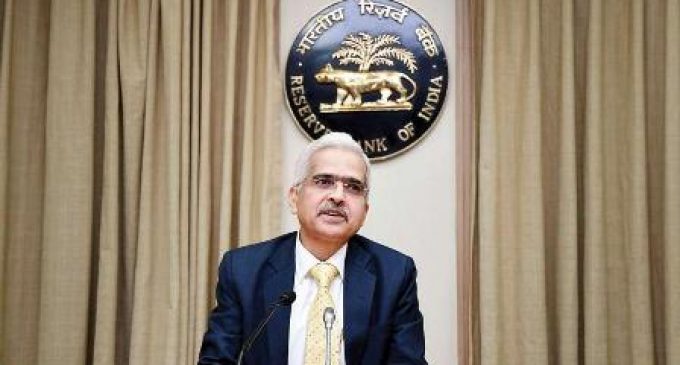

As Governor Shaktikanta Das noted, adjusted for inflation, the repo rate at 6.5% trails at the pre-pandemic levels.

More than policy rates or the inflation outlook, what stood out on Wednesday was RBI’s take on India’s economic growth.

Citing improved economic activity, Das revised upwards FY23 real GDP growth rate to 7% as against his previous prediction of 6.8%. And unlike the conservative projections of Ministry of Finance for next fiscal, Das appeared optimistic pegging growth at 6.4% for FY24. Q1, FY24 growth is estimated at 7.8% followed by Q2 at 6.2%, Q3 at 6%, and Q4 at 5.8% with risks evenly balanced.

The MPC missed its December quarter CPI estimates with Q3 headline inflation printing at 6.1% compared to the central bank’s estimate of 6.6%. Perhaps, this prompted the monetary mandarins to call in for a correction. However, as indicated last year, retail inflation will remain above the RBI’s 4% target band throughout the next fiscal to settle at 5.3%. In all likelihood, real rates will be 100 bps higher than FY24’s inflation forecast. So Das promised to remain ‘agile and alert to the moving parts of the inflation.’

The stickiness in core inflation remains a ‘matter of concern’ for RBI’s Monetary Policy Committee (MPC), and Das stressed the need to ‘see a decisive moderation’ in core prices. Until then, the MPC will remain unwavering. He also justified the moderation in the size of the rate hike at 25 bps as appropriate, allowing them space to assess the lagged impact of the past rate hikes and also provide elbow room to weigh incoming data and determine its next course of action.

Even though the MPC raised repo rate by 250 bps, the weighted average of lending rates on both fresh loans and outstanding loans rose by 137 bps and 80 bps respectively. Likewise, the term deposit rates shot up 213 bps and 75 bps. In other words, the rate hikes delivered so far are still mid-air and need to land tip first. Das wasn’t specific, but markets believe we are at the end of the tightening cycle and as inflation eases with each clock tick, it’s only a matter of time before policymakers begin gunning for growth.

Unlike the December policy when Das was explicit that our inflation battle wasn’t yet over, on Wednesday he refrained from giving any update. He, however, stuck to the need for further calibrated monetary policy action to keep inflation expectations anchored, break core inflation persistence and contain second-round effects. He also hammered home the point that the future course of action would be data dependent and based on the evolving outlook of global crude and commodity prices, geopolitical tensions, domestic economic activity and the impact of past rate hike actions.

Global central banks are at various stages. If the US Federal Reserve and the Bank of England are data-dependent, the European Central Bank continues to be hawkish, while the Bank of Canada is ready to press the pause button. Lower imported inflation, slower demand amid monetary transmission, and base effects should directionally imply lower headline and core inflation next fiscal. With monetary conditions still accommodative compared to pre-Covid levels, RBI’s tone remained cautious and contrary to expectations, the MPC maintained its ‘withdrawal of accommodation stance,’ in a 4-2 split vote.

-PTI